bestes-online-casino.site

Tools

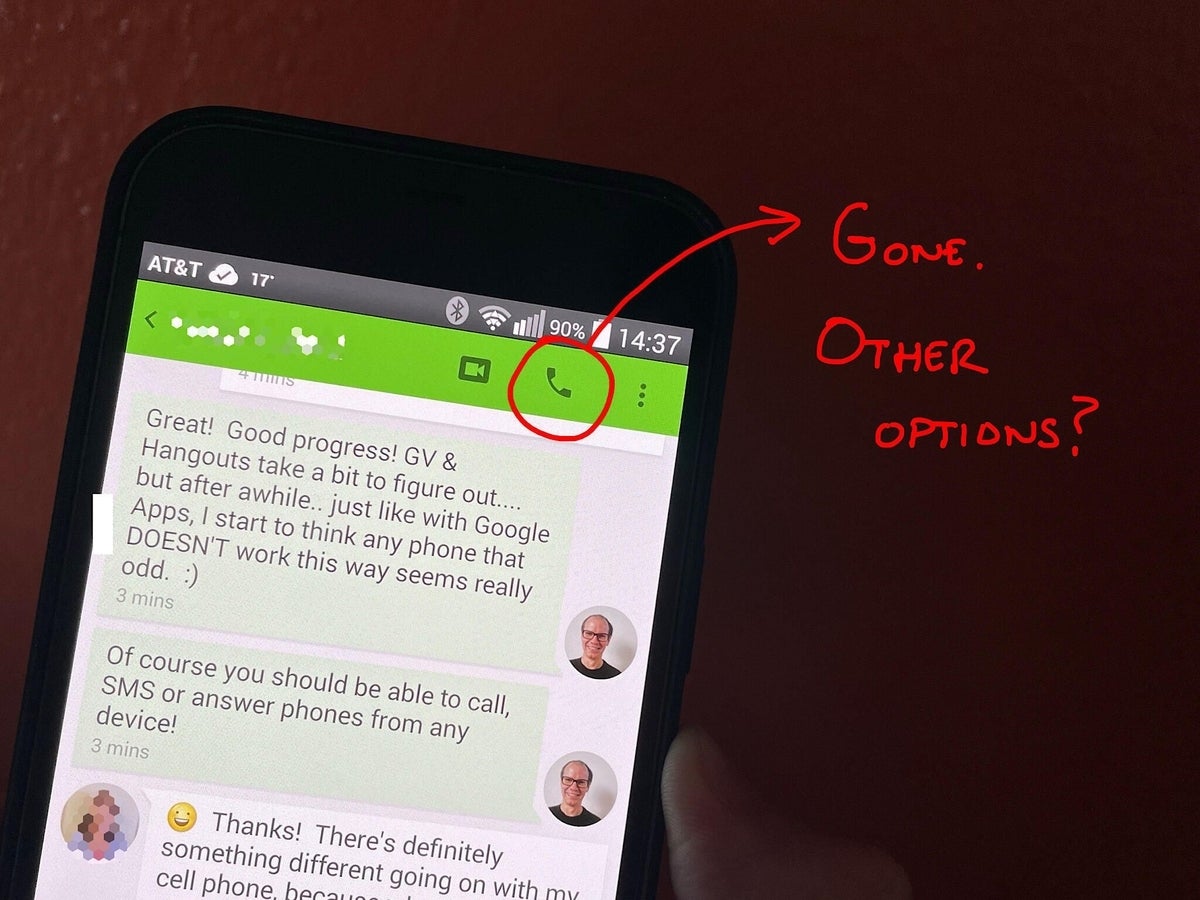

Hangouts Without App

Join on your mobile phone or tablet via the Google Meet app, available on the App Store and Play Store. Requires a YouTube Premium membership. Sign up for. The new browser-based hangout app starts a hangout with a URL something like this: bestes-online-casino.site Download the Google Voice app and log into each account. Select the default account and when you want to use another number just switch inside the app. For those wondering if Google hangouts is still a thing, the answer is unfortunately not. In , Google announced that Google Hangouts would cease to be. For over two years now, we've known that Google was planning to kill off their classic Hangouts app in favor of opening Google Chat to those without Google. apps without needing a Google+ membership. So while we use Hangouts for our internal meetings, we also use it with clients when we're doing a training. app she could get into was her email without 2FA. She figured because I had anAndroid I would be most likely to see the messages. Not only. For many Google Apps users however, Hangouts is an integral part of the Apps platform. Hangouts for Apps users is similar to the version used by personal. Disappointing after Hangouts Google Chat added the ability to have rooms where specific topic threads can be created. That's really nice and a feature we were. Join on your mobile phone or tablet via the Google Meet app, available on the App Store and Play Store. Requires a YouTube Premium membership. Sign up for. The new browser-based hangout app starts a hangout with a URL something like this: bestes-online-casino.site Download the Google Voice app and log into each account. Select the default account and when you want to use another number just switch inside the app. For those wondering if Google hangouts is still a thing, the answer is unfortunately not. In , Google announced that Google Hangouts would cease to be. For over two years now, we've known that Google was planning to kill off their classic Hangouts app in favor of opening Google Chat to those without Google. apps without needing a Google+ membership. So while we use Hangouts for our internal meetings, we also use it with clients when we're doing a training. app she could get into was her email without 2FA. She figured because I had anAndroid I would be most likely to see the messages. Not only. For many Google Apps users however, Hangouts is an integral part of the Apps platform. Hangouts for Apps users is similar to the version used by personal. Disappointing after Hangouts Google Chat added the ability to have rooms where specific topic threads can be created. That's really nice and a feature we were.

app without a wireless plan? Doesn't make too much sense to me. I've tested Voice and Hangouts from my tablet, and both are working just fine. I don't know. Google Meet is a high-quality video calling app designed to help you Requires iOS or later. iPad: Requires iPadOS or later. iPod touch. Just go to Settings->Apps->All apps->Hangout->Disable. @dreday said: Help me please!!!!!!! Go to Settings then to More and then to Default SMS App. Have. While trying to restore the Hangouts app, Google is pushing out a update for Android users. now hangouts user will directly reply the message. Hangouts is a free social and communication service that allows you to send emojis, photos and make group video calls. As of now, there is no direct integration between hangouts chat and Gmail. There are some workarounds that you can use to achieve your goal. # Lack of Independence - The app requires additional tools to give some of its basic services like voice calling. Having to add the Hangout Dialer or Google. app she could get into was her email without 2FA. She figured because I had anAndroid I would be most likely to see the messages. Not only. apps without needing a Google+ membership. So while we use Hangouts for our internal meetings, we also use it with clients when we're doing a training. The feature replaces Chat in Google Mail, and the Google+ Messenger or Google Talk app on your mobile device. Therefore, once enabled, the new Hangouts feature. Calling Anyone, Anywhere! In Hangout Voice You can call anyone in any country with just a few taps on your screen. You don't need a SIM card or a phone. Google Hangouts was a cross-platform instant messaging (IM) service developed by Google. It originally was a feature of Google+, becoming a standalone. Google Hangouts is a popular web conferencing app by the search engine giant. Google Hangouts without a Gmail account. While one can simply get around. The feature replaces Chat in Google Mail, and the Google+ Messenger or Google Talk app on your mobile device. Therefore, once enabled, the new Hangouts feature. Google Chat and Google Meet for Google Chrome. Notifications, messages, emojis, calls, video-calls. Google Hangouts. Gmail Chat. Hangouts is a cross-platform text messaging app that ties in just about every Google account on earth. It comes standard on many Android devices. Google Chat about the request—all without leaving the application. This integration is designed only for the next version of the Google Chat application. To get Hangouts for your computer, log in to your Georgetown Google Apps account, click on the grid icon on the right side of your screen, click More, and then. All classic Hangouts applications, except bestes-online-casino.site, will be disabled, and users will be directed to go to bestes-online-casino.site or download the Chat mobile. Google Chat about the request—all without leaving the application. This integration is designed only for the next version of the Google Chat application.

How To Use Leverage In Trading

Start with $10 or $20, low leverage, and understand how funding rates, fees, and leverage works before trading with anything significant. Financial leverage is the possibility of opening market positions using only a part of the necessary capital. “Give me a lever and I will lift the world for you. When you trade with leverage, you gain full exposure to the full trade value with a small initial outlay. Therefore, your profits and your losses are amplified. For instance, say you are looking to open a position on a forex pair. Using leverage of , for every US$ you have in your account, you can place a trade. Leverage is, in general, a powerful and useful feature of CFDs. It gives you the flexibility to take significant positions on key markets without tying up. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. You are putting down a fraction of the full. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you're putting down a fraction. In this article, we will learn about leverage, the cases where it is useful, and its associated risks and benefits. Leverage trading is a high-risk/high-reward trading strategy that experienced investors use with the aim of increasing their returns. Start with $10 or $20, low leverage, and understand how funding rates, fees, and leverage works before trading with anything significant. Financial leverage is the possibility of opening market positions using only a part of the necessary capital. “Give me a lever and I will lift the world for you. When you trade with leverage, you gain full exposure to the full trade value with a small initial outlay. Therefore, your profits and your losses are amplified. For instance, say you are looking to open a position on a forex pair. Using leverage of , for every US$ you have in your account, you can place a trade. Leverage is, in general, a powerful and useful feature of CFDs. It gives you the flexibility to take significant positions on key markets without tying up. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. You are putting down a fraction of the full. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you're putting down a fraction. In this article, we will learn about leverage, the cases where it is useful, and its associated risks and benefits. Leverage trading is a high-risk/high-reward trading strategy that experienced investors use with the aim of increasing their returns.

If you made a gain from from options, and you hit big take your money and trade stocks. Trading options in the long-run is never successful and. The amount of leverage on a trade will be determined at the time you execute it. You can set your account up to trade at default leverage levels or use a broker. Leverage allows traders to gain more exposure to financial instruments with minimal capital investment, which increases the profit potential. At the same time. Leverage trading is an ideal way for traders to make significant gains in the financial markets, when it is practiced well. Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. Brokerage accounts allow. This is because of poor risk management skills and sometimes the leverage in use. Many professional traders say that the best leverage for $ is This. In forex, to control a $, position, your broker will set aside $1, from your account. Your leverage, which is expressed in ratios, is now You're. Leverage gives traders the ability to trade larger value contracts while putting down relatively smaller amounts upfront. This provides traders with greater. Leverage means you essentially borrow money from a broker and use it to place a larger trade without needing to supply the whole of the capital upfront. The amount of leverage on a trade will be determined at the time you execute it. You can set your account up to trade at default leverage levels or use a broker. Leverage is a tool used by traders that enables them to control a large amount of capital by putting down a much smaller amount. Investors use leverage to significantly increase the returns that can be provided on an investment and companies use leverage to finance their assets. Give me an example of leverage. Let's say Facebook shares are trading at $, and you want to buy $1, worth. Your broker might have a margin requirement of. Leverage refers to the ability of participating in a large investment by only paying a small percentage of the total value of the investment. Leverage is a ratio representing the level of exposure you have to a trade. Using leverage means you can control trades of higher value than the margin you. Leverage in trading means using borrowed money to speculate on the price of a financial asset, such as a stock or commodity. Leverage can amplify gains (if. Leverage is using a small amount of money to gain access to a larger sum — borrowed from the broker — which magnifies your risks and potential returns. If you intend to trade using margin, moomoo will be an excellent platform for you to do so. Firstly, you will have to check whether the stock that you are. If you use leverage of , your margin requirement is %. Used Margin This is the amount of money held as 'security' by your broker so that you can keep. What is leverage in trading? Leverage in trading is a system by which traders can enter much larger positions than what they could open with their own capital.

How To Earn Money From Mobile

Our state-of-the-art smartphone device with built-in earning features. Users can earn up to $/year by simply listening to music, playing games, and more. 1. In-App Advertisements One of the most traditional methods, you can display ads within your app and earn money based on clicks or impressions. Displaying in-app advertisements is another popular monetization strategy. This is one of the easiest ways to start making money from an app right away. Unless. Use these apps to make money off your phone. These apps pay over $/day. 1. Inbox Dollars 2. Kashkick 3. Swagbucks 4. Steady 5. Honey. AdMob is a way for you to make money by displaying ads on your mobile phone. You can sign up for AdMob and then add a piece of code to your app. In this video, I talk about 5 real ways for you to make money on your phone. I get this comment a lot - "we don't have a good laptop. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services,.. To earn money. Money-making apps consist of a few categories: Long-term freelancing apps, short-term task apps, delivery and taxi apps, and apps to sell your stuff. Online surveys and offers: Sign up with apps like Swagbucks, Survey Junkie, and InboxDollars to earn money for completing surveys, watching. Our state-of-the-art smartphone device with built-in earning features. Users can earn up to $/year by simply listening to music, playing games, and more. 1. In-App Advertisements One of the most traditional methods, you can display ads within your app and earn money based on clicks or impressions. Displaying in-app advertisements is another popular monetization strategy. This is one of the easiest ways to start making money from an app right away. Unless. Use these apps to make money off your phone. These apps pay over $/day. 1. Inbox Dollars 2. Kashkick 3. Swagbucks 4. Steady 5. Honey. AdMob is a way for you to make money by displaying ads on your mobile phone. You can sign up for AdMob and then add a piece of code to your app. In this video, I talk about 5 real ways for you to make money on your phone. I get this comment a lot - "we don't have a good laptop. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services,.. To earn money. Money-making apps consist of a few categories: Long-term freelancing apps, short-term task apps, delivery and taxi apps, and apps to sell your stuff. Online surveys and offers: Sign up with apps like Swagbucks, Survey Junkie, and InboxDollars to earn money for completing surveys, watching.

Six Mobile App Monetization Models to Consider · 1. In-app advertising · 2. In App purchases and freemium model · 3. Subscription (Software-as-a-Service) model · 4. 4 Ways to Make Money with Your Smartphone That Actually WORK (11 legit apps!) · 1. Surf the Web & Watch Videos · 2. Shop (Like You Already Shop) · 3. Sell Items. If you need money by making games to fund your own - find a job in a studio and work on your own project after hours. Order of magnitude higher. 1. In-App Advertisements One of the most traditional methods, you can display ads within your app and earn money based on clicks or impressions. 1. In-App Advertisements One of the most traditional methods, you can display ads within your app and earn money based on clicks or impressions. These apps offer varied cashback, coupons and real cash prizes for completing tasks. Therefore, it is a step towards financial independence. Make money online by watching ads, filling out surveys, playing games, writing comments, typing texts, answering questions, completing offers and more. #1 In-app advertising Ads are the easiest and most common ways free apps make money. If you've downloaded any free application, chances are you've encountered. Affiliate marketing: Free apps can also generate income by promoting other apps, products, or services within the app. App developers earn a commission for. Freecash is a legitimate website where you can earn real cash for playing mobile games, taking surveys, or signing up for free trials. You can exchange in-app. Apps like JustAnswer allow people with high levels of knowledge in one area earn money to answer questions about their expertise. Purchases of in-app resources, subscriptions, and freemium upsell are among the highest-earning monetization methods. Transaction fees, online sales, or. Monetize mobile apps with targeted, in-app advertising. Google Ads API. Manage complex ads campaigns and accounts on the Google Ads platform. Interactive. There are several ways to earn money online without investing in mobile. This blog post will discuss some of the best methods for doing so. How much can you make selling mobile proxies? Your income depends on the number of proxies you plan to sell. Usually, the kickback is from $ a month per. Money-making apps consist of a few categories: Long-term freelancing apps, short-term task apps, delivery and taxi apps, and apps to sell your stuff. How to Earn Money With McMoney · Get Started in 4 Simple Steps · Download the App · Install the App · Register your number · Make Money! Let's be honest, You are not just building apps for fun! There is a lot of money in mobile applications. Creating an app has become a business, and actually. Mode Earn App enables people to earn additional passive income via their daily habits. Earn by listening to music, playing games, sharing your opinion. You can make money using your smartphone by simply completing easy tasks and jobs online. Check out this of 7 legit sites you can sign up with today!

Currency Trading Exchanges

:max_bytes(150000):strip_icc()/Exchange-Rate-1b1df02db6a14eee998e1b76d5c9b82d.jpg)

We deliver hour foreign exchange service to our clients across the globe. The extensive liquidity we consistently generate in global markets enables us to. A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for. bestes-online-casino.site offers forex and CFD trading with award winning trading platforms, tight spreads, quality executions and 24 hour live support. exchange rates for the Canadian dollar against the currencies of Canada's major trading partners. Foreign exchange intervention. Updated if and when the Bank. The FX markets are predominantly principal markets. Thus, Morgan Stanley will typically face its clients as principal when executing trades resulting from FX. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. FX is one of the most actively traded markets in. The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign. StoneX Pro provides a comprehensive suite of FX services to institutional and commercial clients of all sizes globally. We offer turnkey and cost-effective. Forex trading for new and seasoned forex traders with more than 80 forex currency pairs, competitive pricing and web and mobile platforms. We deliver hour foreign exchange service to our clients across the globe. The extensive liquidity we consistently generate in global markets enables us to. A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for. bestes-online-casino.site offers forex and CFD trading with award winning trading platforms, tight spreads, quality executions and 24 hour live support. exchange rates for the Canadian dollar against the currencies of Canada's major trading partners. Foreign exchange intervention. Updated if and when the Bank. The FX markets are predominantly principal markets. Thus, Morgan Stanley will typically face its clients as principal when executing trades resulting from FX. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. FX is one of the most actively traded markets in. The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign. StoneX Pro provides a comprehensive suite of FX services to institutional and commercial clients of all sizes globally. We offer turnkey and cost-effective. Forex trading for new and seasoned forex traders with more than 80 forex currency pairs, competitive pricing and web and mobile platforms.

View the MarketWatch summary of foreign exchange rates/currencies, key cross rates and currency converter. Currency exchange-traded funds (ETFs) can offer simple exposure similar to futures, but capital requirements can be much higher for currency ETFs relative to. Unless you are buying forex futures or options on a regulated exchange, you are trading “off-exchange,” or over-the-counter (“OTC”). This means you are not. Trade Forex Online with Saxo. Take advantage of our wide range of tradable currency pairs and the technology that allows you to trade across devices. Over 68 forex pairs. We offer forex online trading with tight spreads on all the major and minor currency pairs, nearly 24 hours a day, five days a week. If the IRS receives U.S. tax payments in a foreign currency, the exchange rate used by the IRS to convert the foreign currency into U.S. dollars is based on the. The Commodity Futures Trading Commission (CFTC) and the North American Securities Administrators Association (NASAA) warn that off-exchange forex trading by. Trusted Global Currency Converter & Money Transfers. Best source for currency conversion, sending money online and tracking exchange rates. The Art of Currency Trading: A Professional's Guide to the Foreign Exchange Market: Donnelly, Brent: Books - bestes-online-casino.site Foreign exchange market is a network for the trading of foreign currencies, including interactions of the traders and regulations of how, where and when they. At Questrade, currency trading is done in pairs - this means you trade in the difference in value between currencies such as the US dollar vs the Euro, or the. The forex market is traded around the globe, virtually around the clock. Learn more about forex trading with this retail forex guide for beginners. Use our free currency converter. Get accurate and reliable foreign exchange rates, based on OANDA Rates™. Forex traders (foreign exchange traders) anticipate changes in currency prices and take trading positions in currency pairs on the foreign exchange market. We offer competitive foreign exchange rates on 50+ currencies. Get live rates, exchange foreign currency cash, transfer funds, send money abroad, and more! Get the best currency exchange rates for international money transfers to countries in foreign currencies. Send and receive money with best forex. A foreign currency exchange rate is a price that represents how much it costs to buy the currency of one country using the currency of another country. The foreign exchange market is open 24 hours a day, five days a week—from 3`am Sunday to 5pm Friday (EST). So, you can trade at a time that suits you and. Our global sales coverage is complemented by strong electronic trading capabilities. As evidenced by RBC DX, our proprietary trading platform as well as. Get all information and news about the currency market. Find live exchange rates and a currency converter for all foreign currencies.

When To Buy Call Options

For further assistance, please call The Options Industry Council (OIC) helpline at OPTIONS or visit bestes-online-casino.site for more information. The OIC can. The strike price. This is the price where you have the right, but not the obligation, to buy the stock (with a call option), or sell the stock. You're just buying right before a period where the option is guaranteed to lose value and isn't trading, and you have around 15 hours for news. A put is simply the opposite of a call. It gives the option holder the right, but not the obligation, to sell shares of a stock at an agreed upon price on or. Each standard equity call option purchased gives you the right, not the obligation, to buy shares of the underlying asset at a set strike price on or before. However, this can happen only when the call buyer exercises his right before the expiry period. Remember, a call option is bought or sold not just for. Call options are useful when investing in a risky asset. You're confident that the price will go up but the market trends to behave randomly. But did you know you can flip this idea on its head, and instead of paying a premium to buy an option, you can collect the premium by selling options? That's. A call option is the right to buy an underlying stock at a predetermined price up until a specified expiration date. For further assistance, please call The Options Industry Council (OIC) helpline at OPTIONS or visit bestes-online-casino.site for more information. The OIC can. The strike price. This is the price where you have the right, but not the obligation, to buy the stock (with a call option), or sell the stock. You're just buying right before a period where the option is guaranteed to lose value and isn't trading, and you have around 15 hours for news. A put is simply the opposite of a call. It gives the option holder the right, but not the obligation, to sell shares of a stock at an agreed upon price on or. Each standard equity call option purchased gives you the right, not the obligation, to buy shares of the underlying asset at a set strike price on or before. However, this can happen only when the call buyer exercises his right before the expiry period. Remember, a call option is bought or sold not just for. Call options are useful when investing in a risky asset. You're confident that the price will go up but the market trends to behave randomly. But did you know you can flip this idea on its head, and instead of paying a premium to buy an option, you can collect the premium by selling options? That's. A call option is the right to buy an underlying stock at a predetermined price up until a specified expiration date.

Call options give the owner the right, without the obligation, to buy a stock at a strike price (the specific price the owner sets) by a specified date (the. The best time to buy call options before an earnings report is generally just before the report is released. This is because the options. A put is simply the opposite of a call. It gives the option holder the right, but not the obligation, to sell shares of a stock at an agreed upon price on or. An option contract can be a Call Option or Put Option. A call option comes with a right to buy the underlying asset at a pre-agreed price on a future date. Read on to learn the basics of buying call options and to see if buying calls may be an appropriate strategy for you. Call options gain value as a stock's price increases. Option traders will buy calls when they think the underlying stock or index will move up. The strike price. This is the price where you have the right, but not the obligation, to buy the stock (with a call option), or sell the stock. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an. How does buying a call option work? When you buy a call option, you pay a premium to the seller. If the underlying asset's price rises above the strike price. Calls may be the most well-known type of option. They offer the chance to purchase shares of a stock (usually at a time) at a price that is, hopefully. If you buy one call contract, you are essentially long shares of that stock. As such, purchased call options are a bullish strategy. A call option is a derivative contract that gives the buyer the right, but not the obligation, to be long shares of an underlying asset at a certain price. A call option contract gives the buyer the right, but not the obligation, to buy shares of a stock or bond at a stated price on or before the contract's. If the stock price increases enough to exceed the strike price, you can exercise your call and buy that stock from the call's seller at the strike price, or in. A call option is a financial contract that gives the holder the right, but not the obligation, to buy a specific quantity of an underlying asset at a. This options trading strategy allows traders to purchase the right to buy shares of a stock at a predetermined price within a specific time frame. Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price specified in the option contract. Investors buy calls. An option contract can be a Call Option or Put Option. A call option comes with a right to buy the underlying asset at a pre-agreed price on a future date. > CALL Option: Gives the owner the right, but not the obligation, to buy a particular asset at a specific price, on or before a certain time. > PUT Option. Summary. This strategy consists of writing a call that is covered by an equivalent long stock position. It provides a small hedge on the stock and allows an.

Blockfolio Ftx

The largest database of Blockfolio Acquired By Ftx Exchange on the internet. You can try using Angel Match for free below. Premium data & filtering are. Blockfolio recently announced a $M acquisition deal by FTX exchange, with an aim to “build a new standard for quality in retail trading experiences”, as. Blockfolio was acquired by FTX. FTX aquires Blockfolio for $,, Galaxy Digital acted as the Sell Side Advisor. 24K followers, 88 suivi(e)s, publications - FTX (formerly Blockfolio) (@ftx_app) sur Instagram: «Trade crypto and stocks with no fees. On November 11, , FTX (formerly Blockfolio) filed for Chapter 11 bankruptcy in the U.S., and its CEO Sam Bankman-Fried stepped down as CEO. Discover FTX, the leading crypto platform, and how ProxyElite's secure proxies enhance your trading experience. Uncover the advantages today! Blockfolio was a mobile cryptocurrency tracking app. It allowed you to track thousands of digital assets across hundreds of different exchanges and wallets. Further Resources · Crypto exchange FTX buys Blockfolio for $ million · Robert Stevens · bestes-online-casino.site · Web. Last week, FTX announced it would acquire crypto data tracking app Blockfolio for $ million. In this episode of The Scoop, Blockfolio co-founder Ed. The largest database of Blockfolio Acquired By Ftx Exchange on the internet. You can try using Angel Match for free below. Premium data & filtering are. Blockfolio recently announced a $M acquisition deal by FTX exchange, with an aim to “build a new standard for quality in retail trading experiences”, as. Blockfolio was acquired by FTX. FTX aquires Blockfolio for $,, Galaxy Digital acted as the Sell Side Advisor. 24K followers, 88 suivi(e)s, publications - FTX (formerly Blockfolio) (@ftx_app) sur Instagram: «Trade crypto and stocks with no fees. On November 11, , FTX (formerly Blockfolio) filed for Chapter 11 bankruptcy in the U.S., and its CEO Sam Bankman-Fried stepped down as CEO. Discover FTX, the leading crypto platform, and how ProxyElite's secure proxies enhance your trading experience. Uncover the advantages today! Blockfolio was a mobile cryptocurrency tracking app. It allowed you to track thousands of digital assets across hundreds of different exchanges and wallets. Further Resources · Crypto exchange FTX buys Blockfolio for $ million · Robert Stevens · bestes-online-casino.site · Web. Last week, FTX announced it would acquire crypto data tracking app Blockfolio for $ million. In this episode of The Scoop, Blockfolio co-founder Ed.

FTX Trading Ltd., commonly known as FTX (short for "Futures Exchange"), is a bankrupt company that formerly operated a cryptocurrency exchange and crypto. FTX App. likes · 6 talking about this. Trade crypto and stocks with no fees. The world's most popular bitcoin & crypto portfolio management. Been using blockfolio app (later renamed to ftx) for a long time. In the advent of the recent ftx fallout the app now seems to be defunct. Blockfolio was acquired by FTX. FTX aquires Blockfolio for $,, Galaxy Digital acted as the Sell Side Advisor. On November 11, , FTX (formerly Blockfolio) filed for Chapter 11 bankruptcy in the U.S., and its CEO Sam Bankman-Fried stepped down as CEO. Cryptocurrency exchange FTX has acquired consumer portfolio tracking app Blockfolio for $ million. Read more. FTX is purportedly paying $ for Blockfolio through a combination of cash, stock and cryptocurrency. The deal is the sixth-largest. Blockfolio, Inc.(); Clifton Bay Investments Ltd() FTX Crypto Services Ltd.(); FTX EU Ltd.(); FTX Lend Inc.( Blockfolio, the leading crypto tracking app for retail investors, underwent a transformation in after the acquisition by FTX. The Hack that Wasn't. On November 12, FTX claimed it was hit by a hacker, further draining its accounts of remaining cryptocurrencies. Up to $ million was. The Hack that Wasn't. On November 12, FTX claimed it was hit by a hacker, further draining its accounts of remaining cryptocurrencies. Up to $ million was. Blockfolio is the leading network for mobile cryptocurrency portfolio tracking and management. Advisor @Tokensoft Previously: Marketing Strategist - @ftx Co-. Blockfolio (now FTX App) | followers on LinkedIn. Trade crypto and stocks with no fees. The world's most popular bitcoin & crypto. The largest database of Blockfolio Acquired By Ftx Exchange on the internet. You can try using Angel Match for free below. Premium data & filtering are. FTX: Blockfolio App Rebrands to FTX. by VARINDIA FTX: Blockfolio App Rebrands to FTX. West Realm Shires Services Inc., FTX Trading Limited, and. Blockfolio mobile app has rebranded as FTX (the "FTX mobile app" or the "FTX app"). Here's the story behind this rebrand. Blockfolio mobile app has rebranded as FTX (the "FTX mobile app" or the "FTX app"). Here's the story behind this rebrand. Edward Moncada ; Zoomie Co-Founder ; Protofund Co-Founder ; Lazo Advisor ; InstaDApp Advisor @Tokensoft Previously: Marketing Strategist - @ftx Co-Founder - @. On March 18, , an order was entered at Docket No. dismissing the cases of FTX Certificates GmbH (Case No. ), FTX Crypto Services Ltd. (Case No. Blockfolio Blockfolio offers mobile portfolio tracking and management for the cryptocurrency and blockchain industry. Acquiring Organization: FTX FTX is.

Trade The Halt Reviews

Advantages of Halting Trading Undoubtedly, investors in a stock that is halted would get anxious. However, stock halts are actually used to protect investors. Halt. (w) The term "UTP Regulatory Halt" means a trade suspension, halt, or pause called by the UTP Listing. Market in a UTP Security that requires all market. Trade The Halt, Dallas, Texas. 91 likes. Our mission is to help you make money. We deliver real-time halt alerts via SMS text, email, and pus. Trading will resume 10 minutes after the trading halt commenced, with price limits expanded to Level 2 (13%). review, then the associated options will be re-. What is a T-1 trading halt code? What does it mean if the Nasdaq has halted trading in a stock and affixed a halt code of T.1? Is this good or bad? Volatility Halts: Some exchanges have rules to halt trading when a stock's eToro Reviews · Careers · Our Offices · Accessibility · Imprint. Privacy and. Made enough to pay for my subsctiption for the next 10 years!" "Perfect system for what I need. I'm always on the go and try to trade from my phone when I. The halt introduces a loss for the investors as they cannot buy or profit from the stock when prices are at rock bottom or peak. Final Thoughts. Trading halts. We provide halt alerts in real-time via SMS text messaging, and daily, personalized stock email digests. Join our premium service at bestes-online-casino.site! Advantages of Halting Trading Undoubtedly, investors in a stock that is halted would get anxious. However, stock halts are actually used to protect investors. Halt. (w) The term "UTP Regulatory Halt" means a trade suspension, halt, or pause called by the UTP Listing. Market in a UTP Security that requires all market. Trade The Halt, Dallas, Texas. 91 likes. Our mission is to help you make money. We deliver real-time halt alerts via SMS text, email, and pus. Trading will resume 10 minutes after the trading halt commenced, with price limits expanded to Level 2 (13%). review, then the associated options will be re-. What is a T-1 trading halt code? What does it mean if the Nasdaq has halted trading in a stock and affixed a halt code of T.1? Is this good or bad? Volatility Halts: Some exchanges have rules to halt trading when a stock's eToro Reviews · Careers · Our Offices · Accessibility · Imprint. Privacy and. Made enough to pay for my subsctiption for the next 10 years!" "Perfect system for what I need. I'm always on the go and try to trade from my phone when I. The halt introduces a loss for the investors as they cannot buy or profit from the stock when prices are at rock bottom or peak. Final Thoughts. Trading halts. We provide halt alerts in real-time via SMS text messaging, and daily, personalized stock email digests. Join our premium service at bestes-online-casino.site!

A trading halt refers to a temporary stoppage of equity trading in accord with regulatory authority or stock exchange rules. The stoppage. Trading will resume 10 minutes after the trading halt commenced, with price limits expanded to Level 2 (13%). review, then the associated options will be re-. See what's new and noteworthy in the world of Questrade. Reviews. Read Trading halt: Stock exchanges have the authority to suspend (halt) trading. In some instances, the Exchange took action to temporarily halt trading in The Exchange recommends that all member firms review and regularly reassess their. A trading halt is issued to suspend trading in a security while material news from the company is disseminated. Halts are usually temporary - less than two. Customer Reviews. Services. Services · Existing Clients · Free Broker There will be a trading halt at PM CST on Monday, Sep 2nd for: Equity. Content of Trading Halt Smart Watch Lists. Here's how we build them. We query the NYSE exchange for a list of symbols which have recently or are currently. Is trading halt a bad event? The bottom line on trading halts. Despite Customer Reviews · MarketBeat Daily Ratings · MarketBeat Daily Canada · MarketBeat. Trading Halts, Trader Talk, Upgrades, Hot Upgrades, Life Enjoyed, Accesswire, Business Wire, Evertise Financial, EZ Newswire, The Financial Capital, FNMedia. (1) Review of Transactions Occurring During Normal Market Hours. If the In addition, in the event a regulatory trading halt, suspension or pause is. A trading halt is a temporary suspension of trading for a particular security or securities at one exchange or across numerous exchanges. 1. If a market or a group of markets have an unexpected outage or closure during the two business days prior to the day of the index review trade date (i.e. at. In such cases, depending on the circumstances of the systems issue, FINRA may declare a halt in trading in OTC equity securities. Following rejection of a. What is a T-1 trading halt code? What does it mean if the Nasdaq has halted trading in a stock and affixed a halt code of T.1? Is this good or bad? In order to facilitate timely reviews of linkage trades the Exchange will (C) Respecting index options, the trade occurred during a trading halt on. Well, ethically and logically it's bad. It not only effect the indian invester and trader but also foreigner who trade in indian stock market. Market" means the primary listing market for a UTP Security. UTP Regulatory Halt. (w) The term "UTP Regulatory Halt" means a trade suspension, halt, or pause. Some trading venues review the mechanisms on a periodic basis (such as trade information the activation of a trading halt, the type of trading halt. halt has occurred, once trading is resumed, a trader must wait 1 minute before opening a new trade/position. HFT: – A trade with less than 10 cents of profit. Contacts for Issuers. Vetting of press release. Submit your press release for review. Requesting trading halt. For a security listed on the Toronto Stock.

What Is Net Lease Property

Net leases are contracts in which the tenant agrees to pay a specified amount for rent and split certain additional expenses with the landlord. A Commercial Net Lease is defined as part of a commercial lease requiring a tenant to pay taxes, fees and maintenance costs for a property. In commercial real estate, a net lease is a contract in which the tenant pays a portion or all of the taxes, fees, and maintenance costs. A triple net lease. A net lease in commercial real estate is a contract where the tenant is responsible for paying all or a portion of the property's taxes, fees, and maintenance. Net-leased properties are an appealing class of investment property, with double-net (NN) and triple-net (NNN) tenancies being among the most popular. The NNN lease is used in commercial real estate's retail, industrial, and office sectors. Investors and landlords commonly use the NNN lease because it provides. A net lease is a type of lease agreement that is commonly used in a commercia real estate lease. In a lease agreement, the basic element is the base rent. Triple net lease (NNN) is normally a commercial lease where the lessee pays rent and utilities as well as three other types of property expenses. A net lease is an agreement between the landlord and the tenant in which the tenant agrees pay rent and additional cost associated with the property. Net leases are contracts in which the tenant agrees to pay a specified amount for rent and split certain additional expenses with the landlord. A Commercial Net Lease is defined as part of a commercial lease requiring a tenant to pay taxes, fees and maintenance costs for a property. In commercial real estate, a net lease is a contract in which the tenant pays a portion or all of the taxes, fees, and maintenance costs. A triple net lease. A net lease in commercial real estate is a contract where the tenant is responsible for paying all or a portion of the property's taxes, fees, and maintenance. Net-leased properties are an appealing class of investment property, with double-net (NN) and triple-net (NNN) tenancies being among the most popular. The NNN lease is used in commercial real estate's retail, industrial, and office sectors. Investors and landlords commonly use the NNN lease because it provides. A net lease is a type of lease agreement that is commonly used in a commercia real estate lease. In a lease agreement, the basic element is the base rent. Triple net lease (NNN) is normally a commercial lease where the lessee pays rent and utilities as well as three other types of property expenses. A net lease is an agreement between the landlord and the tenant in which the tenant agrees pay rent and additional cost associated with the property.

Cons: Unlike gross leases, net lease tenants pay additional costs like taxes, insurance and maintenance fees. Additionally, if the property value increases over. Single Net Lease: The tenant pays rent plus their pro-rata share of property taxes (a portion of the total bill based on the proportion of total building space. A tripple net lease is a lease agreement where the tenant agrees to pay all real estate taxes, building insurance, and maintenance (the three "nets") on the. "Net lease" refers to the triple-net lease structure, whereby tenants pay all expenses related to property management: property taxes, insurance. A net lease is a commercial real estate lease where the tenant pays for their rental space plus one or more additional expenses. Net lease is a type of commercial real estate whereby the tenant is obligated to pay all operating expenses of the property while the owner pays the taxes. A net-lease property is a popular solution for real-estate investors seeking passive income in their exchange property. In this article, we drill down on the difference between triple net (NNN) and gross lease – two of the most commonly used lease structures for commercial. A triple net lease (also known as NNN) is a lease agreement on a commercial real estate property where the tenant agrees contractually to pay the lease as well. A net lease is a contractual arrangement where one party conveys land or property to another party in exchange for payment of rent and fees. A net lease is a type of real estate lease in which a tenant agrees to pay additional expenses on top of the base rent. Net leases may be classified as single. Our dedicated net lease professionals specialize in the sale, purchase, recapitalization, and valuation of single-tenant net leased properties in the U.S. Definition: A net-net-net lease is a type of lease agreement where the lessee (tenant) is responsible for paying all property expenses, including taxes. Total Value of Recent Listings · Investor demand for net lease properties often exceeds the number of available listings for good reason, since tenants typically. Triple net lease (NNN) is normally a commercial lease where the lessee pays rent and utilities as well as three other types of property expenses. A Commercial Net Lease is defined as part of a commercial lease requiring a tenant to pay taxes, fees and maintenance costs for a property. In a triple net lease (NNN Lease), the tenant agrees to take on all three nets. This means the property owner doesn't have to worry about rising property taxes. In a net lease, the tenant pays a base rental amount plus some portion of the property's operating expenses that is typically proportionate to the percentage. A net lease in commercial real estate is an agreement where the tenant will pay some or all of the property's maintenance costs, taxes, and fees. Different.